SRI Investing

What is SRI investing?

Sustainable, responsible and impact investing (SRI) is an investment philosophy that considers environmental, social and corporate governance (ESG) criteria to generate long-term competitive financial returns while ensuring positive societal impact. SRI uses both positive and negative screens to include or exclude companies in a portfolio based on social, moral and ethical criteria.

Putting a large emphasis on social and environmental responsibility also does not reduce potential returns. Several research studies have demonstrated that companies with strong corporate social responsibility policies and practices are sound investments, with strong positive returns on investment. A majority of studies also show a positive correlation between ESG criteria and corporate financial performance.

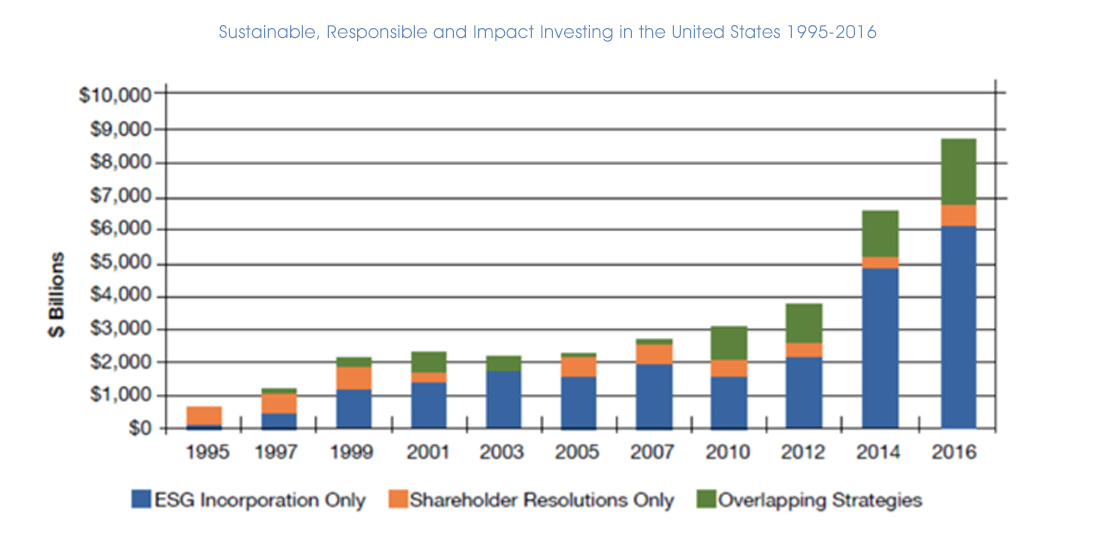

As the figure above shows, institutional investors and money managers are rapidly adopting SRI. In the US alone there is currently an estimated $8.76 trillion in total net SRI assets.

How we embody this philosophy

NH-Capital wholly embraces SRI as it strongly aligns with our own values. Investing in the future, for us means, ensuring that we pass off a better world to the next generation. To accomplish this goal, our private equity division’s focus sectors are education, healthcare and green technology. Our real estate team also ensures all their acquisitions hold up to high standard of environmental qualifications.

We always place a heavy emphasis on a company’s ethical practices and environmentally conscious business model in our investment criteria, whilst continually monitoring our ongoing investments to ensure they continue to uphold the high standard we uphold ourselves too.

The issue of climate change and sustainability will only continue to grow as nations around the world, including China, are adopting new policies and strategies. NH-Capital seeks to not only be a part of this growing trend, but to get a head start to lay the foundations for the future.

WHO WE ARE

- ABOUT NH-CAPITAL

- SRI INVESTING

- OUR PARTNERS